The foundation of how NFTs get their value is akin to any other economic asset. The more limited the supply, the higher its value.

Add uniqueness and the ‘one-of-a-kind’ narrative into the mix, and you get Beeple’s $69 million Everydays - The First 5000 Days.

According to Hugo Chang, from Columbia Business School, there’s a simple formula that can be used to define the value of an NFT.

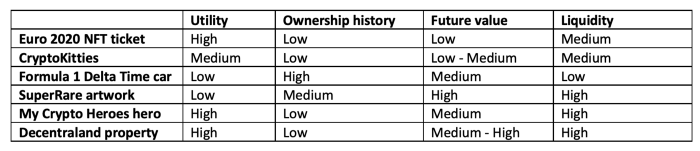

Value of an NFT = Utility + Ownership History + Future Value + Liquidity Premium

Euro 2020 NFT tickets, for example, have low future value but high utility – the ability to use it for watching matches. A IRL application.

NFTs from SuperRare, on the other hand, have low utility, but ‘medium’ future value.

How would you value a NFT? Which projects have the most potential to increase in value over time?